THINKING DIFFERENTLY TO GIVE ECONOMIC DEVELOPMENT SOME ZIP

to level up, A more sophisticated approach may be needed

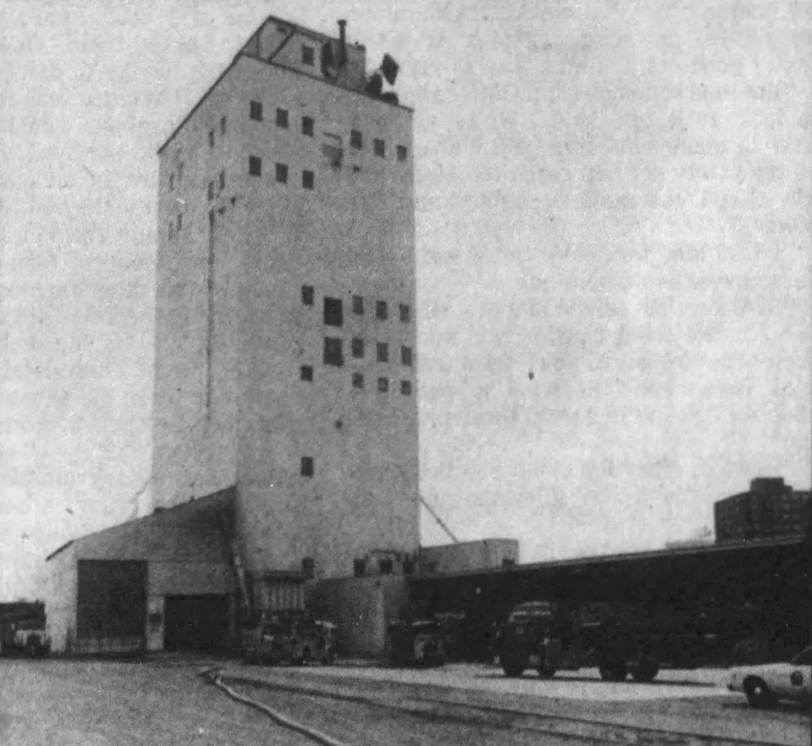

The most advanced feed mill in the world rose along the banks of the Big Sioux River in 1955. Zip Feed—a family business my grandfather built—was once a cornerstone of our regional ag economy. Fifty years later, the city had changed. Downtown evolved beyond the ag economy, and the old mill no longer fit. Removing it wasn’t easy—December 3, 2025 being the 20th anniversary of its attempted demolition—but it cleared the way for a new era.

Jeff Scherschligt seized that moment. With vision and courage, he led the charge to redevelop the same land my grandfather transformed 70 years ago. Cherapa Place didn’t just replace a dated landmark—it signaled a new direction for Sioux Falls. As

Jodi Schwan recently wrote, it also demonstrated the power of public-private partnerships in shaping a city where people want to invest and put down roots.

She’s right. But there’s more to the story.

Downtown didn’t revive because of one project or one approach—it revived because we built an ecosystem. The Façade Easement Program made historic properties investable again and preserved the architecture that gives Sioux Falls its character. Downtown Sioux Falls, Inc. created a clean, beautiful, and engaging atmosphere that attracts people year-round. Add the Washington Pavilion, Phillips to the Falls, and the restoration of Falls Park, and soon downtown became a place where residents and visitors wanted to linger and businesses wanted to be.

As Sioux Falls looks ahead, public-private partnerships will remain essential. But to level up, we may need more sophisticated tools—especially when it comes to financing development.

Tax increment financing (TIF) has moved the needle, but its impact can be limited to the footprint of a single project. Meanwhile, developers here face a persistent challenge—we have Minneapolis construction costs, but bring in Sioux Falls rents, as Scherschligt often points out. Closing that gap calls for creative solutions.

What if we leveraged financial mechanisms, combining programs into a system that strengthens the scope and impact of public and private investment?

Imagine an improvement district encompassing several city blocks centered around a public project—a library, a park, or major streetscape improvements for example. When the City bonds for public projects, it could bond an additional 25% to provide low-interest construction loans specifically for projects within the district, with oversight from a board of supervisors. Then by incorporating TIF for the district, new developments paying into a TIF fund could help offset bond payments. After the bond is paid off and the TIF has matured, the district could convert to a business improvement district to provide cleaning, sanitation, and/or marketing services.

The result? A virtuous cycle: public improvements that catalyze private investment, which in turn strengthens economic activity and the long-term tax base.

If a system like this existed a decade ago for the event center campus, would that area look different today? With good planning, I suspect it would. This is merely one example of how thinking differently about the economic development tools already in use could yield better results. I realize low-interest financing alone won’t solve the cost of construction, but by aligning incentives and lowering financing barriers, we could unlock growth for an area where the market alone struggles to make the math work.

Sioux Falls has a long history of bold projects and forward-thinking leadership. The next chapter may depend on whether we’re willing to innovate not just what we build—but how we make it possible.